Rising interest rates, inflation on the price of building materials, debates on the taxation of real rents, PEB certificates... The context is becoming more complex for the real estate investor. But is it less interesting to buy brick than one year ago? BuyerSide objectifies the debate for you.

Many, if not all, prospective real estate investors at one time or another, necessarily ask themselves the question when is the best time to take the plunge. What if prices were to fall? What if you have to wait a little longer to get your hands on that rare gem? Caution is certainly a good advice. But by waiting for the last carat, these hesitant candidates risk never realizing their projects. Let's objectify the debate for them.

What has changed

The rates. Mortgage rates have risen from 1% at the pinnacle of their historic low to about 3.25% today, which is 2.25% higher than in early 2022 (in 20 years fixed). But according to many economists, this is a return to normalcy, as the previous period of ultra-accommodative central bank policy reflected a very unique situation characterized by almost no inflation and negative market rates at certain moments. And then, what is a borrowing rate of 3.25% when inflation is now running at more than 10%? In reality, despite appearances, the cost of money is much more favorable today than it was two years ago (see the "inflation" section).

PEB certificates. Since October 14, 2022 in the Brussels Region and November 1, 2022 in the Walloon Region, landlords can no longer index their tenants if the energy performance of their property is in EPB category "F" or "G" (or if the landlord does not have an EPB certificate). This is certainly a new constraint for the owners of old buildings, but also an opportunity to make a qualitative leap and, from there, to increase the value (including rental value) of their property. If they do not have the knowledge or patience, BuyerSide, via its sister company OwnerSide, can advise them and offer to follow a project from A to Z as a delegated project manager. It should also be noted that many subsidies are available to increase the energy performance of a home.

The price of building materials. When inflation started to soar, certain construction materials (such as steel, for example, whose price doubled in a few months), not only saw their price explode but also their delivery delayed, putting contractors in the incapacity to give prices, or even push them to cancel orders. However, the situation is now much less tense and is fortunately moving towards a balance.

Plans to tax real rents. In recent months, the federal government has considered taxing actual rents (instead of the flat rate based on cadastral income). But, once again, this "Arlesian" that has been on the political agenda for almost 40 years has not materialized. One thing is certain - and this is assuming that a consensus will ever be reached on the subject - no such measure will be envisaged before 2024.

Inflation.Last but not least, inflation has changed the picture considerably. At 12.27% in October 2022, the highest since 1975, this spectacular rise in prices over one year may seem frightening when it comes to paying energy bills, but it is also the best ally for a real estate investor who has most often taken out a fixed-rate mortgage. Indeed, the Belgian law allows a landlord to index the rent of his tenant at each anniversary date of the lease. This means that the margin between his fixed financial charges and his rental income thus increased through indexation swells mechanically. Inflation is also reflected in the sale prices of real estate, of course.

What is the market situation?

Today, prices evolve differently depending on their destination. We must therefore distinguish:

Investment properties. After a period of overheating, mainly due to a strong imbalance between supply and demand and the lack of alternatives for investments, the price of rental properties has (finally, one would like to say) decreased in real terms. As a result, the market is now full of investment opportunities that were unavailable two years ago. But it will inevitably move towards a new equilibrium when this surplus of supply is exhausted.

Residential property. In contrast to investment properties, the prices of properties for own use (houses and apartments) are not falling.

Conclusion: a rising profitability

In conclusion, the environment could be more favorable for the real estate investor in 2022 than in 2021 as long as the investor finds the "good deal".

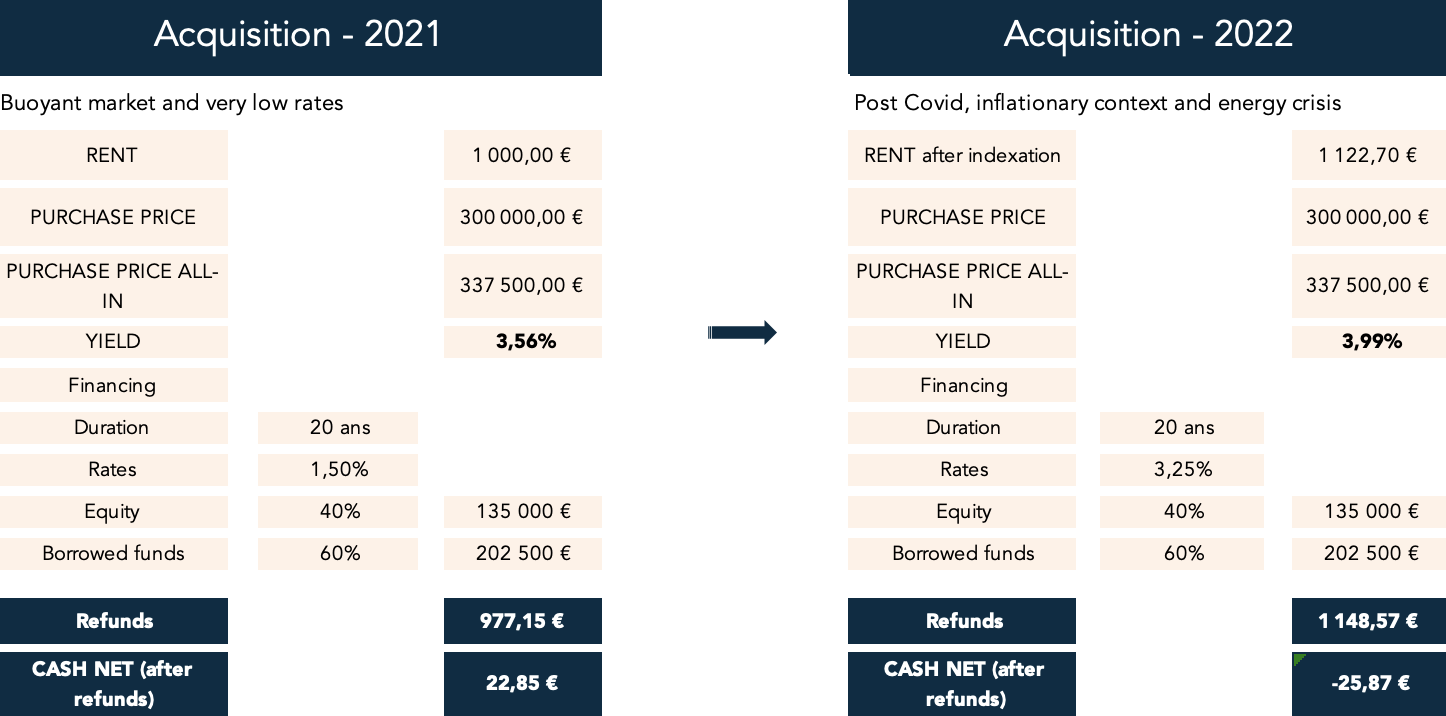

BuyerSide has compared for you, an acquisition in 2021 (when the market was buoyant and the financing rates very low) with an acquisition today, at the end of 2022, in an inflationary market with a strong increase in rates:

In 2021, the investor who bought an apartment at 300.000 € rented at 1.000 € could expect a return of 3,56 % on his investment. By putting in 40% of his own funds and after paying his monthly instalment to the bank for his financing, he would have 22.85 € left in his pocket.

At the end of 2022, the market is no longer the same... his rent has increased by +- 12% following indexation and his financing rate has risen to +- 3.25%, which seriously changes the deal.

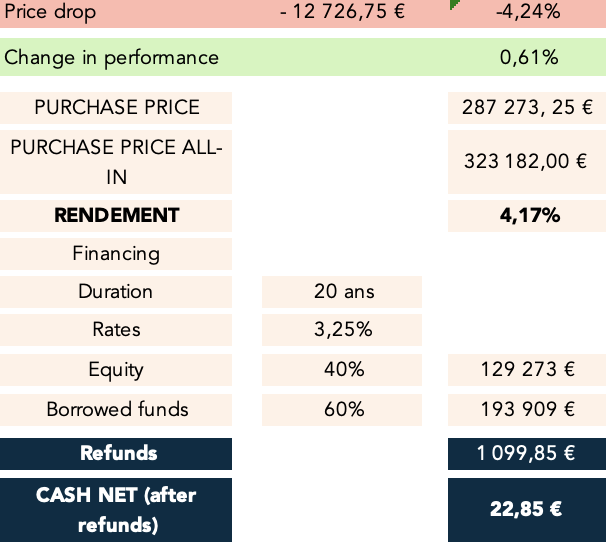

To achieve the same result, the price would have to drop:

BuyerSide estimates that in order to obtain the same net amount of money in his pocket today, the buyer would have to buy at a higher yield.

In one year, the gross profitability deed in hand (i.e. the ratio between 12 months of rent and the purchase price of the property plus related costs) has thus increased from 3.56% to 4.17%, an expected increase of 60 basis points.

The rise in rates is then offset by inflation and a fall in prices for rental properties.